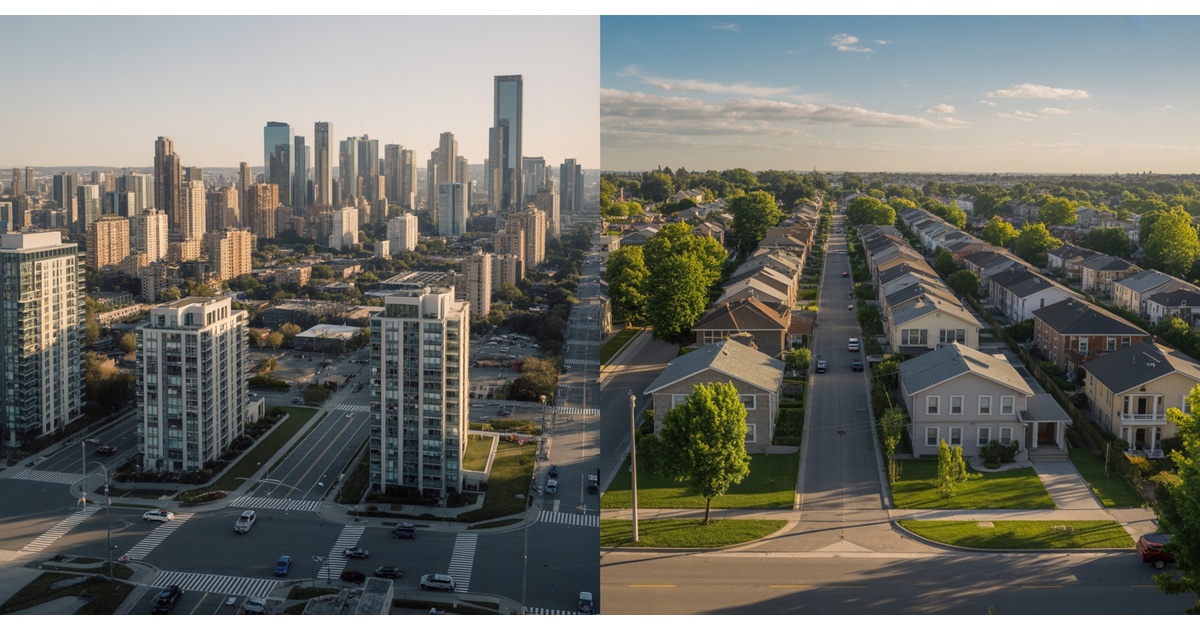

A $100,000 salary in San Francisco provides the same purchasing power as $53,000 in Nashville. Understanding cost of living differences is critical whether you're relocating for a job, retiring to a new state, or simply wondering if you're overpaying to live where you do.

This comprehensive guide breaks down every cost category you need to compare: housing, taxes, groceries, transportation, utilities, healthcare, and more. Use our data-driven approach to calculate exactly what you need to earn in any ZIP code to maintain your lifestyle.

What You'll Learn

- Complete cost breakdown by category

- How to calculate salary equivalents

- Hidden costs most people overlook

- State tax differences by ZIP code

- Real-world cost comparisons (6 cities)

- How to use our comparison tool

Helpful Resources

Hotels.com - Visit Before You Move

Book accommodations to explore your new city before relocating

Find Hotels →Choice Home Warranty

Protect your new home with comprehensive warranty coverage

Get Free Quote →Sponsored links • We may earn a commission

7 Major Cost Categories to Compare

1. Housing (28-35% of budget)

The single largest expense. Includes mortgage/rent, property taxes, homeowners insurance, and HOA fees.

Pro Tip: Use our ZIP code comparison tool to see median rent and home prices in any neighborhood.

2. State & Local Taxes (0-13%)

State income tax, sales tax, and property tax rates vary dramatically. Some states have no income tax at all.

No State Income Tax:

- ✅ Texas (Austin, Dallas, Houston)

- ✅ Florida (Miami, Tampa, Orlando)

- ✅ Tennessee (Nashville, Memphis)

- ✅ Washington (Seattle)

- ✅ Nevada (Las Vegas)

Highest State Income Tax:

- ❌ California (up to 13.3%)

- ❌ New York (up to 10.9%)

- ❌ New Jersey (up to 10.75%)

- ❌ Oregon (up to 9.9%)

- ❌ Minnesota (up to 9.85%)

Real Impact: On a $100K salary, California's 9.3% state tax = $9,300/year. In Texas: $0.

3. Transportation (10-20%)

Car payment, insurance, gas, maintenance, parking—or transit passes if you're car-free.

✅ Car-Free Possible

- • NYC (~$130/mo transit)

- • SF (~$80/mo Muni)

- • Chicago (~$100/mo CTA)

- • DC (~$80/mo Metro)

❌ Car Required

- • Most suburbs ($400-600/mo)

- • Phoenix ($350-500/mo)

- • Atlanta ($400-600/mo)

- • Houston ($400-600/mo)

4. Groceries & Food (10-15%)

Grocery costs vary 30-40% across the US. Urban areas tend to be more expensive.

Real-World Cost Comparisons

| City (ZIP) | Housing | Taxes | Groceries | Transport | Total/Mo | Salary Needed |

|---|---|---|---|---|---|---|

| San Francisco, CA (94103) | $4,800 | $1,100 | $520 | $150 | $6,750 | $120,000 |

| NYC (10001) | $4,200 | $1,050 | $480 | $127 | $6,017 | $110,000 |

| Austin, TX (78701) | $2,400 | $0 | $380 | $250 | $3,175 | $80,000 |

| Denver, CO (80202) | $2,200 | $180 | $360 | $220 | $3,090 | $75,000 |

| Nashville, TN (37203) | $1,900 | $0 | $340 | $280 | $2,655 | $65,000 |

| Phoenix, AZ (85004) | $1,650 | $105 | $330 | $260 | $2,500 | $60,000 |

Note: Monthly totals for a single professional. Family costs 2-3x higher. Salary needed calculated at 35% tax rate + 20% savings.

Helpful Resources

Aceable Real Estate School

Get your real estate license online with flexible courses

Start Learning →Choice Home Warranty

Essential home protection for your real estate investment

Get Coverage →Sponsored links • We may earn a commission

Hidden Costs People Overlook

💰 Childcare Costs

Daycare ranges from $600/mo in rural areas to $2,500/mo in NYC and SF. For two kids, this can exceed rent.

National average: $1,200/mo per child

🏥 Healthcare Premiums & Deductibles

Family health insurance: $800-1,500/mo. High-deductible plans can mean $5K-10K out-of-pocket before coverage kicks in.

❄️ Heating & Cooling Costs

Minnesota winter heating: $300/mo. Arizona summer AC: $250/mo. Mild climates save $100-200/mo year-round.

🅿️ Parking Costs

Urban parking: $200-500/mo. Manhattan can exceed $700/mo. Suburban homes include free parking.

The Bottom Line

Cost of living comparisons are essential for making informed decisions about where to live. A higher salary doesn't always mean more money in your pocket—what matters is purchasing power after accounting for housing, taxes, and all other expenses.

Use our comparison tool to see how your current salary translates to different ZIP codes. You might discover that moving to a lower-cost area with a slightly lower salary actually increases your savings and quality of life.

Remember: The "cheapest" place isn't always the best value. Consider career opportunities, quality of life, schools, and long-term financial goals when making your decision.

Compare Cost of Living in Any ZIP Code

Use our free comparison tool to see housing costs, taxes, and purchasing power across 40,000+ U.S. ZIP codes.

Related Articles

Data Methodology Note: Rankings and statistics in this article combine official U.S. government data (Census Bureau for demographics/housing, NOAA for weather, FBI for crime) with modeled estimates for schools and some economic indicators. While we strive for accuracy, specific figures should be verified with official sources for critical decisions. Learn more about our data sources and methodology.